There have been sporadic issues with the supply of certain products over the course of the Coronavirus pandemic that has now characterised our lives for 18 months. While the early phase was marked by shortages of toilet paper and medical masks, we are now facing a scarcity of timber, plastic granules and integrated circuits. Are these the consequences of a (hopefully) unique situation that will resolve itself once normalcy is restored? Or do our economy’s production processes, which are based on a global division of labour, face risks so great that fundamental restructuring is essential?

Company survey shows hardly any adjustments to the value chain

The Konrad-Adenauer-Stiftung and the ifo Institut intend to investigate this issue as part of a large-scale study. It will be published in mid-August 2021. In this context, the ifo Institut also asked companies about their plans to change procurement strategies as an additional part of the Business Survey (ifo Economic Forecast) in spring 2021. The findings of the exclusive Business Survey provide a clear indication that, at most, isolated adjustments in the economic entanglements between companies are deemed necessary. Only a minority of the interviewed companies are planning to adjust their procurement strategy at all. They account for 41 per cent in the manufacturing industry, 35 per cent of wholesale companies, 27 per cent in the retail sector and a mere ten per cent of the services sector, which is less dependent on procurement.

Only sparse strategic changes in procurement

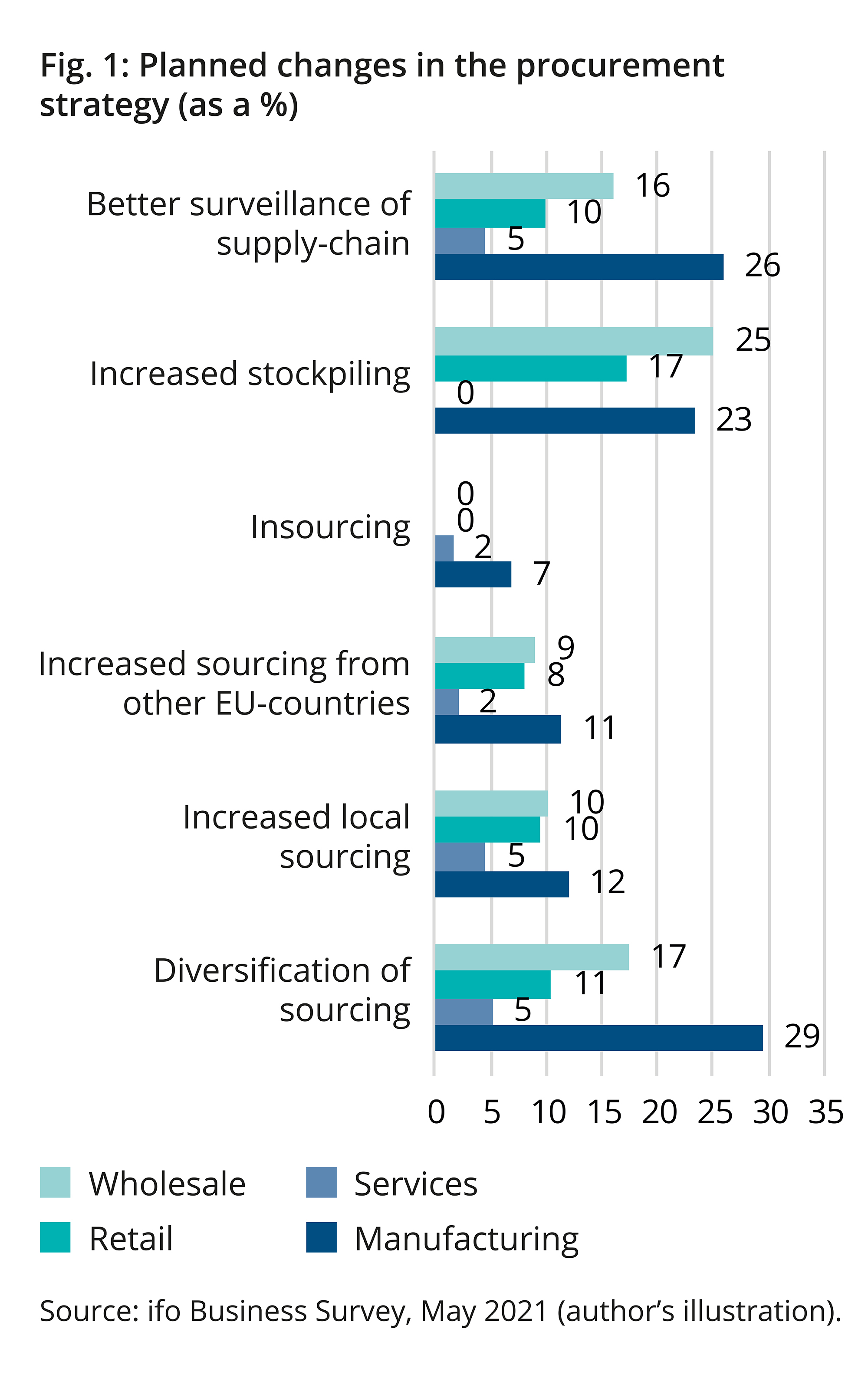

Even companies that plan to make changes are barely addressing their fundamental strategy of procuring precursors from around the world. In all four sectors of the economy included in the survey, the most frequently mentioned adjustment responses are stockpiling, improved monitoring of supply chains and diversified procurement, which means identifying additional suppliers:

Fig.1: Planned changes in the procurement strategy (as a %). Source: ifo Business Survey, May 2021 (author’s illustration).

A minority of German companies are planning insourcing

As the diagram shows, only a minority of the surveyed companies plan to increase their procurements in Germany or the EU. This response is even less pronounced in the retail and services sectors. Very few companies intend to carry out additional processing stages themselves.

Companies have to face challenges of the market economy

Even more notable is the breakdown according to sectors, which only included manufacturing—the area most strongly affected by the supply chain bottlenecks. Here, it is primarily the sectors that are impinged by shifts in global supply and demand structures that are planning to make changes to their strategy. At the top of the ranking are the electrical equipment (57 per cent), rubber and plastic goods (55 per cent), and furniture (53 per cent) sectors. These are evidently responses to isolated changes, and the findings clearly do not indicate a process of deglobalisation, observed equally across all sectors. In some sectors, after all, plans to change the procurement strategy are far less common. This applies, for example, to the food and animal feed industry (26 per cent), metal production and processing (27 per cent) or even the important motor vehicles and motor vehicle parts sector (35 per cent).

The current shortages of integrated circuits, plastic granules and timber largely appear to be short-term fluctuations in demand in the wake of the Coronavirus pandemic. These fluctuations may nevertheless coincide with longer-term structural changes. This assumption seems likely, for instance in view of the surging demand for the frequently-cited integrated circuits. Irrespective of the reasons for the scarcity, the ability of companies to adjust to new situations should continue to be seen as a normal part of entrepreneurial challenges in a market economy.

No need for political action in the value chains

The findings of the Business Survey therefore demonstrate clearly that the Coronavirus pandemic has not sparked a deglobalisation trend in the German economy. Companies apparently do not feel particularly moved to adopt a sweeping strategy to bring production home to Germany or Europe. At most there are isolated sectors in which problematic dependencies exist. They warrant detailed investigation and a calm, case-by-case assessment of how these effects can be mitigated. Scheduled for publication in August 2021, the Business Study will surely provide options. One thing already seems clear: there is no acute need for political action with regard to value chains.